Personal injury settlements and lottery winnings are the two ways to come into piles of money all at once without having to do anything in particular other than buy a ticket or perhaps get run over by someone with good insurance coverage. Like Minerva born from the brain of Zeus, let’s consider amassing piles of samoleans ab ovo. One day you’re standing there in the market deciding whether or not to spring for the non-generic Frosted Flakes and the next you have a stack of Franklins equivalent to what you would have earned working fifty hours a week for fifty years.

$5,000,000 after-tax greenbacks will be considered for the purposes of the fantastical conversation. What to do with a stack of one dollar bills 17-stories high? Do you pay off your mortgage? Or do you buy a new three-million-dollar home? Do you continue going to work every day? Or do you quit your dreary job and start day drinking? Do you toss the kids in that camper and see the National Parks? Or do you tour European capitals, staying in five-star hotels? Are there any more PBJs in your life or is it surf and turf for breakfast and brunch?

Invested safely at four percent—the United States government isn’t going anywhere—you have $200,000 a year for the rest of your days. You can make meaningful charitable contributions and—in the fullness of time—have heirs who will be sad but not poor when you die and they inherit. Whereas if you start hemorrhaging money, you will have nothing left. Take it to the bank; it is possible to burn through any amount. Even five million dollars can evaporate. Ask anyone who has done it.

Lots of lottery winner end up with nothing. There is some data to suggest that as many as 70% of lottery winners go bankrupt. But even one person who squandered five million clams would be a riches to rags tragedy.

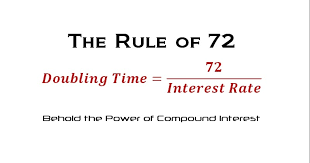

How is it possible to go from $5M to zero? Were I the sort of person to point fingers, throw stones, hurl invective, and assign blame—oh, wait! That’s exactly the kind of person I am!–I might be concerned about curriculum. All those lottery winners threw all that money in the ocean? There must be an emotional component but I wonder about the understanding of arithmetic. I’m uneasy about kids who can solve quadratics but don’t know the rule of 72. I’m a big fan of algebra specifically and abstract math in general. But there’s no sense being fluent in calculus, getting a degree in chemical engineering, earning buckets of money, only to have your assets stripped away by poor financial planning, spending more that you earn, investing in race horses and other dodgy investments. Monte Hall will never ask you if acceleration is the derivative of velocity. (It is, Monte! It is! The rate of change of speed is acceleration!) But your credit card company will help you understand that the dollar you borrow today becomes two dollars that you have to pay back in four short years at the prodigious rate of 18%.

X times Y equals 72 where X is the interest rate and Y is the number of years until your money doubles. If you are earning six percent, your dollar becomes two dollars in 12 years. (6 x 12 = 72.) Maybe percents, the time value of money, and personal finance should be emphasized in math classrooms. Are we spending too much time on unit circles and trigonometric identities? Not everyone needs to know how to graph a hyperbola, but everyone should have the fundamental skills necessary to understand amortization. A conic section can’t qualify for a mortgage or make payments on a home, but you children can and probably should.

Speaking of winning the lottery, having a healthy child is a gift beyond counting. The exquisite answer to the most fundamental arithmetic inquiry in the delivery room is, “Yes! Ten fingers! Ten toes!” When two people go to the hospital and three people come home, it’s like winning five million dollars. Every time you tell your child, “What’s wrong with you?” “I don’t have time for you!” “You should know that already!” you’re tossing bundles of hundred dollar bills out the window. Talk about a way to achieve moral bankruptcy in a hurry.

The arithmetic is simple, the solution straightforward. For loving parents, just remember that you are your child’s first and best teacher. In arithmetic instruction, as in all areas, take your children where you find them. When your kids understand their times tables, gently introduce, “fifty percent of 80 is 40.” When they are comfortable with, “what percent of 50 is 20?” move on to “A hundred dollars invested at 10 percent simple interest is how much eight years later?”

Having helped your kids with this critical arithmetic, you are on the way to lots of good outcomes. If you do win the lottery and rent that camper to visit the national parks, you’ll have something to talk about as you drive from Bryce Canyon in Utah to Yosemite in California. And if you don’t win the lottery–this just in: you won’t–your children will have the necessary arithmetic skills to avoid credit card debt and to invest in a sensible home.

Happy children, good relationships, arithmetically literate. It all adds up! Hanging out with your (financially savvy, unstressed, contented) kids is the biggest win of all!

2 thoughts on “Don’t Blow it”

Where were you when I was growing up? I now officially blame you–not my parents–for every emotional issue I have had to (or thought i had to) face. You’ll be hearing from my therapist. (My mother is going to be SO happy!)

–Auntie Evan

Once again you have hit the mark.

I would love to see financial planning built into the school curriculum (along with shop, art, music).

I could have benefitted!