Student loan forgiveness has been a national discussion recently. My colleagues in the independent counseling world have been penning insightful posts about the subject. My limited understanding of the arguments on both sides is as follows: in favor, “student debt is onerous and unfair.” Against, “hard working folks shouldn’t have to pay for the college dalliances of others.”

I have never taken a stance on a political issue in these 639 blog posts. And I promise not to start now–opinions being like digestive systems in that everyone has one but nobody wants to hear about yours.

I will mention my own path to a college education when a kid selling hot dogs in the Orange Bowl during Dolphin games could earn enough money to make a significant contribution toward his tuition. Simple arithmetic will suggest that no matter how many hotdogs a kid hawks in 2022, they can’t make a dent in college costs–even though hot dogs no longer cost 45 cents and, I imagine, hot dog vendors earn more than six and a half cents per dog distributed. The point being that middle class families could afford college half a century ago; I was graduated without debt.

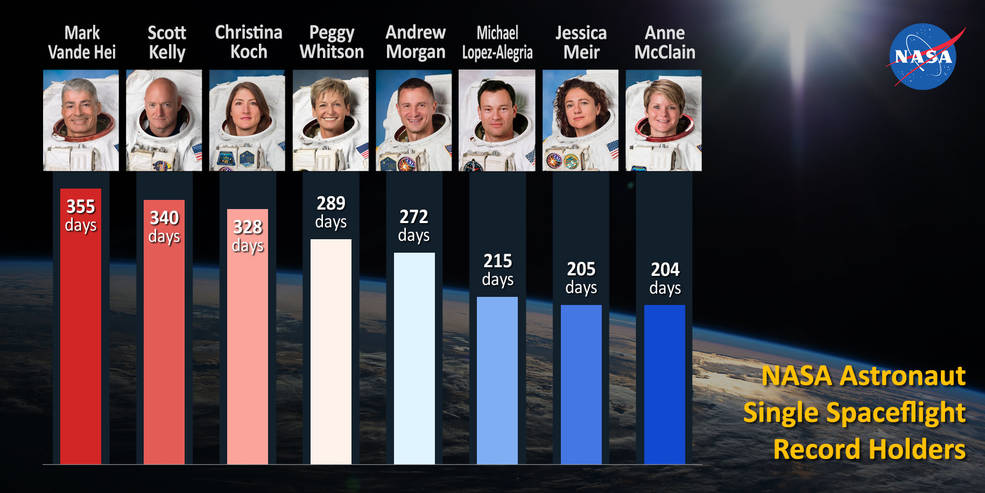

Again, my point this week has nothing to do with policy. I’m going to make a comment about the role of counselors in suggesting what our students should get their degrees in. I studied math as an undergraduate. I did not go on to get a PhD. I was not nearly smart enough, motivated enough to take graduate level courses in mathematics. I have never worked at NASA or the NSA. The folks at the Institute of Advanced Studies at Princeton have nothing to fear from me.

My dad and I tossed a football when I was a boy. I never went on to lead an NFL team to the playoffs.

Yet somehow, I have managed to muddle through life neither teaching math at the university level nor taking snaps under center for the Fins.

To suggest that return on investment is the only measure of the value of an undergraduate degree is to miss, I would argue, almost the whole point of going to college.

The GMAT used to have questions asking students to determine the underlying assumptions of a passage. I get the vibe that part of our discussion about the “value” of a, say, journalism degree, is that the average salaries of J School graduates are less than that of, say, chemical engineering or aeronautical engineering, graduates.

We all know this joke:

The graduate with an engineering degree asks, “How does it work?” The graduate with an accounting degree asks, “How much will it cost?” The graduate with a liberal arts degree asks, “Do you want fries with that?”

But not all of our students have the horses (ability) or the whip (motivation) to be an engineer.

www.indeed.com/career-advice/pay-salary/…

- Financial analyst

- Industrial engineer

- Mechanical engineer

- Biomedical engineer

- Nuclear engineer

- Petroleum engineer

- Civil engineer

- Aerospace engineer

- Electrical engineer

- Chemical engineer

Given that it took me less than a minute of Internet “research” to unearth the above list, I am going to go out on a limb and suggest that I am not the only person on the planet Earth who is aware that nine of the top ten highest paying jobs have the word “engineer” in them. I’m told that engineers take a lot of math courses. I imagine financial analysts do also.

With this data, is it therefore our responsibility as counselors to insist that all of our students study engineering and eschew journalism as well as-gasp!-sociology, teaching, and literature?

Or should we instead make full disclosure: “If you are graduated with more debt that you are likely to earn in a year, you will delay significantly your ability to purchase a home, start a family, or save for retirement.” And then we can show our kids salary ranges for teachers and public defenders in different parts of the country.

I agree that the folks who offer student loans–“debts no honest man could pay” as Bruce Springsteen put it–are no better than people pushing Xanax on the street or tobacco at the corner store. But if the alternative to a frank discussion is a patronizing and off-point polemic about how only some fields are worth studying doesn’t move the conversation forward.

I enjoyed tossing a ball with my dad. I learned a lot by studying math. I make my living and I make my life as an independent counselor. And I toss a ball with my children. I don’t have a lot of regrets about these choices. I hope my students don’t regret the direction that I help them find-whether they study engineering or sociology.

3 thoughts on “R. O. I.”

Simple. The American people did not sign a contract to borrow money, the student did. I’m not very tall. The NBA won’t lower the basket for me. You made the deal, your problem. This admin is straddling us with yet another TRILLION dollar decision with his magic wand (unconstitutionally I might add).

Well said. College has become a big business in large part because of student accessibility to loans made by banks that are fully guaranteed by the government. The student is another pawn used by the schools and banks. When I went to college and law school it was affordable. I have no knowkege about the salaries paid to the professors. It’s a win, win for the banks. The default rate is significant especially for those who attended private schools that began after the game started to play., e.g. Trump University.

You don’t need a college degree to become a plumber, electrician or other tradesman who make good livings. The purpose of college was supposed to be enlightment and acquistion of knowledge. Times have changed. We won’t be able to put the Genie back in the box.

Not mentioned in your overview:

1. More than half the outstanding debt is to borrowers who owe less than $10K because they borrowed to go to a vocational school, not college.

2. More than half the delinquencies are to borrowers who never finished their vocational courses.

3. The average student loan balance upon college graduation is less than $30K, not only less than the average salary of those graduates but also less than the average cost of a new car.